Private Credit Fund

Investment Highlights

Stable Income Generation:

Predictable cash flows prioritized through senior capital stack positions.

Strong Downside Protection:

Investments secured by real property assets, with rights to asset control in default scenarios.

Retirement Account Compatible:

Investors may use self-directed IRAs.

Diversification:

Strategically diversified across property types, markets, and sponsorship teams.

Sponsor Alignment:

Management team co-investing personal capital.

Target Net Cash Yield

Lockup

Class A Minimum

Funding Deadline

Redemption

Class B Minimum

Investor Suitability

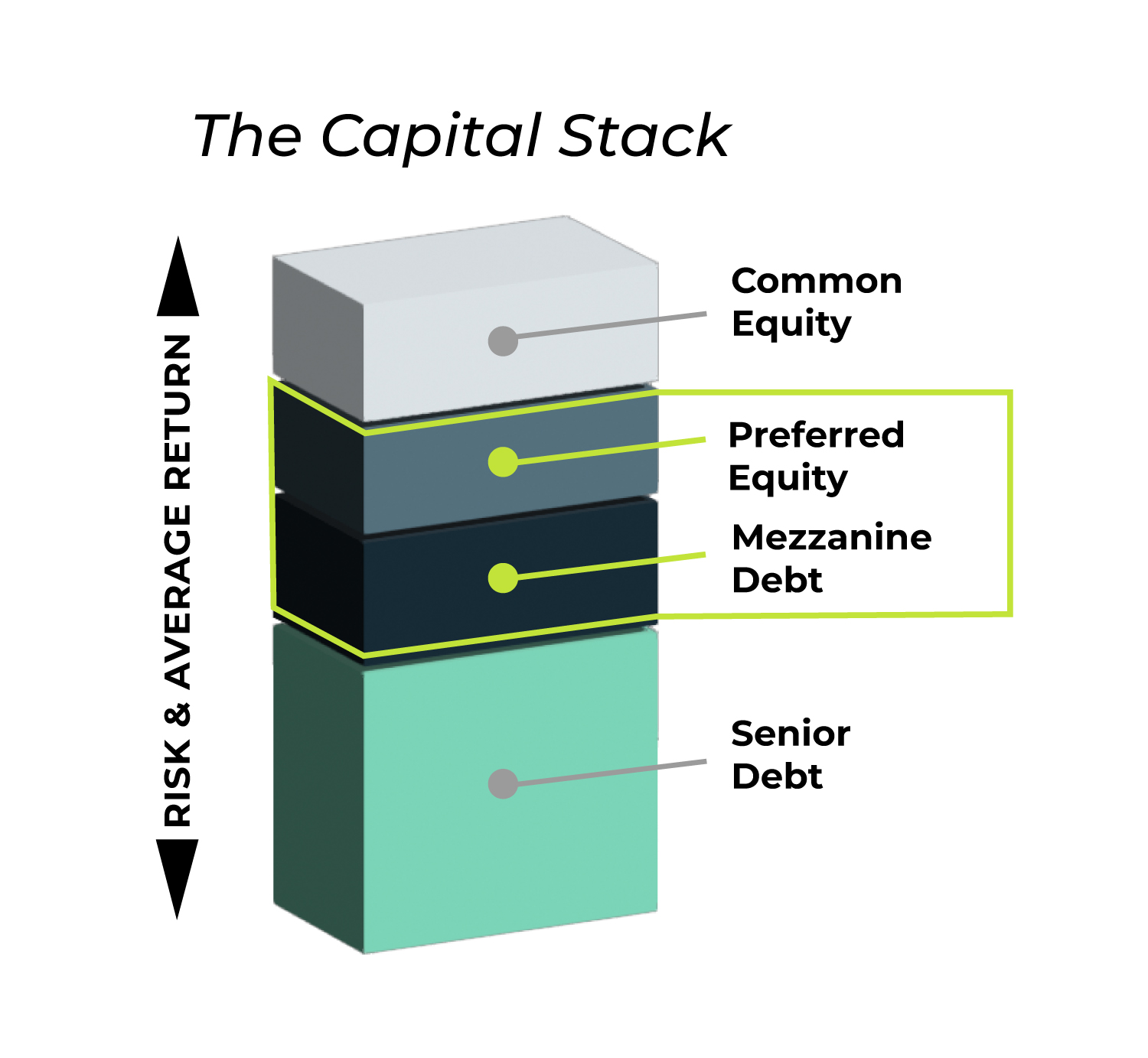

The Private Credit Fund is a stable, open-ended, income-focused investment fund designed specifically for investors seeking predictable, high-yield quarterly cash flow paired with robust downside protection. This fund strategically invests in a balanced mix of private debt and preferred equity positions, all within carefully vetted, quality commercial real estate projects. Our disciplined investment approach ensures steady performance and capital preservation, even during market volatility.

What's in the Fund?

The Fund’s portfolio includes

Preferred Equity Investments:

Providing substantial equity cushions (25-45%), the right to assume management or force asset sales in default scenarios.

Mezzanine Debt Positions:

Higher-yielding, secured loans subordinated only to senior debt, further enhancing portfolio security.

Key Assets Include:

- Multifamily properties in growing markets (Missouri, Georgia, Arkansas, Kansas, Oklahoma).

- Medical office buildings with strong tenancy and location fundamentals (Colorado).

- Industrial assets purchased significantly below replacement cost (Georgia).

- Neighborhood retail and manufactured housing portfolios with robust cash flow (Kansas, Ohio, Indiana).

For full details on assets, please ask for the Offering Memorandum

Benefits of Investing in Private Credit

- Priority of payment before common equity

- Current cash flow

- Lower in the capital stack, reduces risk of capital loss

- Generally can takeover the deal or force a sale if not meeting expectations.

Fund Overview

Target Allocation:

50/50 Mezzanine Debt/Preferred Equity

Asset Types:

Diversified across multifamily, medical office, industrial, retail, and manufactured housing.

Historical Performance:

Currently delivering an annualized yield of approximately 11% net of fees to Class A investors.

Cash Flow:

Quarterly distributions targeting 9–12%+ annualized.

Tax Efficiency:

Distributions reported via K-1, providing tax efficient income and access to ordinary losses (approximately 20% expected this year due to preferred equity positions) .

Share Classes:

Class A Minimum: $50,000 (10% Target Yield).

Class B Minimum: $500,000 (12% Target Yield).

Additional Investments: Incremental additions are welcome at any time in increments of $1,000.

Cash Flow or Compounding Options:

- Quarterly cash distributions with annualized cash yields between 9–12% .

- Option to automatically reinvest distributions for compound growth, or receive quarterly cash payments.

- Investors may change their selection at any time.

Tax Advantages:

- K-1 Reporting (Not 1099-INT): Provides tax-free quarterly income distributions.

- Passive Losses: Investors gain access to ordinary passive losses, enhancing overall tax efficiency.

- For the current year, passive losses are expected to represent approximately 20% of invested capital due to preferred equity positions.

- Liquidity and Flexibility

- Open-Ended Structure: New capital contributions accepted at any time.

- Redemptions: Optional liquidity after a 2-year lock-up period, subject to availability.