Real Estate Syndication

Leverage the Power of Multi-Family Investing

Own tangible assets alongside like-minded investors. Unlock tax benefits, adjusted risk, and above-average returns — all with expert guidance from Tamarack.

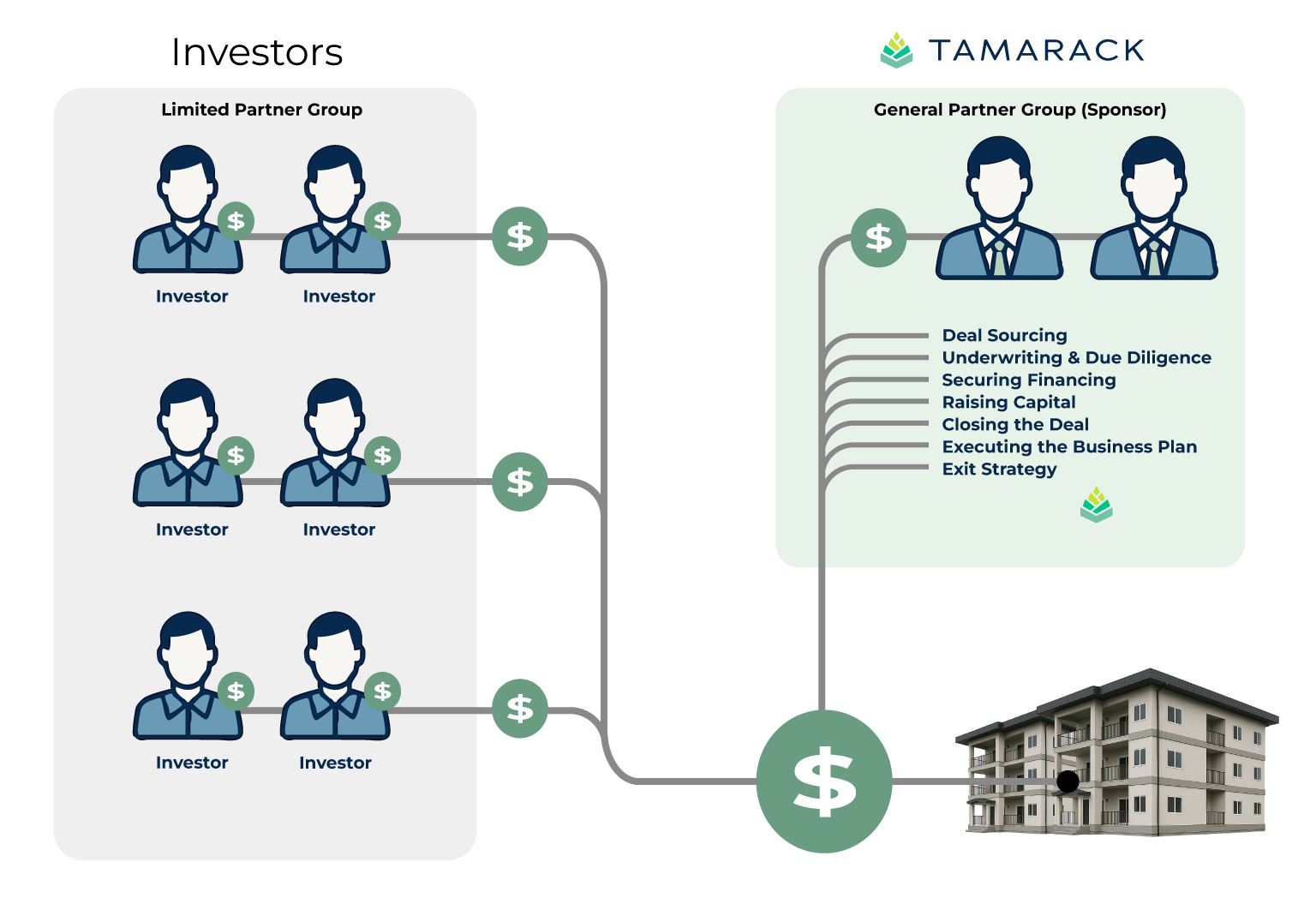

Invest through syndication

Our unique approach focuses on acquiring existing multi-family properties, injecting them with new life, and maximizing their value – all while providing investors with unparalleled opportunities for equity growth and passive income through syndicated deals.

Advantages of syndicated investing.

At Tamarack, we guide you through every step — from understanding syndication to making confident investment decisions. Whether you’re new or experienced, our personalized support ensures you feel secure and informed.

Stability

Real estate, less volatile than stocks, has consistently outperformed the S&P 500. With Tamarack you can leverage a larger asset class than investing alone.

Balanced Risk

Large Multi-Family projects allows us to weather storms better than other real estate investments.

Equity Building

Through strategic renovations, we boost property values, enhancing your equity in the deal.

Cash Flow

Enjoy monthly rental income, covering expenses and offering a source of passive income. We target 6-8% Cash on Cash quarterly dividends on stabilized properties.

Stronger Returns

Our value add process adds value, creates strong cashflows as well as enjoying the benefit from the long-term appreciation of real estate values.

Tax Advantages:

By leveraging depreciation and 1031 exchanges, your investment operates much like a supercharged Roth account. This strategy allows you to defer taxes while potentially accessing your capital through cash-out refinancing.

Apply Now to Join our Investing Club.

At Tamarack, we guide you through every step — from understanding syndication to making confident investment decisions. Whether you’re new or experienced, our personalized support ensures you feel secure and informed.

Invest through syndication

Our Investment Process

Our process was born out of combined 18 years of real estate investment experience with over $165M in assets acquired.

We look for medium sized multi-family properties that can provide a 15% aggregate return. We aim for appreciation, cash flow, varying exit options, and reduced pressure on the investor.