Investing is a powerful tool for building wealth, but navigating the various strategies can be challenging. This guide will break down the concepts of passive and active investing, providing insights that will empower you to make informed decisions for your financial future.

What Is Active Investing

Active investing is a hands-on approach where investors directly control their investment decisions. This strategy is driven by the belief that financial markets are inefficient and can be exploited through practical research and analysis.

Active investors often use various techniques, such as market timing and stock picking, to outperform the market averages.

Typical Approaches and Strategies

1. Fundamental Analysis

Examining financial statements and other economic indicators.

2. Technical Analysis

Using historical price data and market trends to predict future movements.

3. Market Timing

Attempting to buy low and sell high based on market conditions.

Active Investment Opportunities

Active investing involves a hands-on approach, allowing investors to directly manage their assets and make strategic decisions to maximize returns.

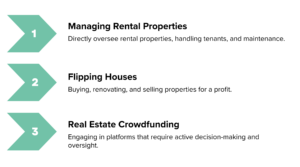

Examples of Active Investment Opportunities

Pros of Active Investing

Active investing is geared toward those who prefer direct control over their assets and are willing to dedicate time to managing their investments.

- Direct Control: Investors can influence outcomes by making informed decisions based on personal insights.

- Strategic Decision-Making: The ability to pivot strategies based on real-time market data can uncover potentially lucrative opportunities.

- Liquidity Timing: Investors can decide when to sell for maximum gains, optimizing their financial returns.

- Transparent and Lower Fees: In many cases, active investments may come with more transparent and potentially lower fees compared to passive strategies.

Understanding Passive Investing

Passive investing, on the other hand, adopts a more hands-off methodology, focusing on long-term growth without frequent trading or constant market monitoring.

Definition and Approach of Passive Investing

Passive investing aims for long-term growth by mirroring market performance through diversified portfolios, reducing the need for daily decision-making.

Overview of Common Passive Investment Strategies

- Index Fund Investing: Purchasing index funds that track the performance of specific market indices.

- REITs (Real Estate Investment Trusts): Investing in professionally managed portfolios of real estate assets.

Examples of Passive Investment Opportunities

- Real Estate Syndication: Investing in a real estate syndication where professional managers handle the properties.

- Pension Plans: Contributing to diversified pension plans without the necessity for hands-on management.

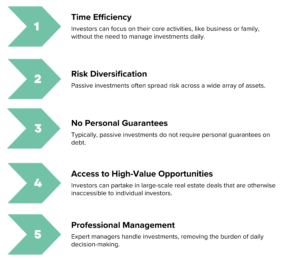

Pros of Passive Investing

Passive investing is suited for those who want to grow their wealth without dedicating significant time to their investments.

More On Active vs Passive Investing

How do passive real estate investments, such as REITs, compare to active property management in terms of long-term capital appreciation and cash flow generation?

Passive investments like REITs may offer more consistent dividend income, while active property management can lead to higher overall returns if managed well, though it might involve more risk and effort.

How can real estate investors effectively leverage tax incentives and depreciation differently in passive versus active real estate investments?

Active investors can take advantage of real estate professional status to maximize deductions, while passive investors may be limited to passive losses, though they can still benefit from depreciation and tax credits.

What are the advanced risk management strategies for balancing passive and active real estate investments in a diversified portfolio?

A balanced portfolio may involve allocating a set percentage to each strategy, regularly reviewing performance, and learning to hedge risks through diversification across asset types or geographical locations.

Conclusion

Determining whether Active vs Passive Investing works for you is not a one-size-fits-all decision. Each investment style offers distinct advantages and disadvantages, mainly dependent on personal goals and risk tolerance. Before diving into investing, consider what aligns best with your lifestyle and financial objectives.

Where to Put Capital in 2026? Here’s How We’re Thinking About It

As we head into a new year, one question keeps coming up from investors we talk to: “Where should I…

A Once-Per-Decade Opportunity Is Beginning to Emerge

Multifamily continues to lead all asset classes in investment activity nationwide, and that’s not changing. Over the past few years,…

Sponsor alignment in the search for capital

For those that are new to syndicated deals or multifamily development. The “Sponsor” is the group putting the deal together.…

A Look at Tamarack’s Current Multifamily Strategy in the Tri-Cities | Feb 2026

Our team is deep in the mix across several multifamily opportunities in the Tri-Cities—and for the first time, we’re pursuing…

Balancing Risk During Underwriting: How Tamarack Approaches Risk and Return

We live in a world that often celebrates speed, flash, and outsized ambition. In investing, that translates into IRRs that…

Fixed-Rate vs. Floating Debt: What Real Estate Investors Need to Know Right now

Debt is one of the most powerful tools in real estate investing. It can magnify returns, improve cash flow, and…

Three Paths to Real Estate Investing—And Which Might Fit You Best

Let’s start with the truth: Real estate investing can feel overwhelming. Everyone seems to have a different approach. Some are…

Building Financial Independence Through Real Estate: A Smarter Way Forward:

The path to financial freedom isn’t paved with one-size-fits-all advice. For many, the traditional approach—working 40 years, saving 10% of…

From CFO to LP: Why Financial Professionals Are Turning to Passive Real Estate Investing

For years, finance professionals and corporate leaders have relied on traditional investments to grow their wealth. Stocks, bonds, and retirement…

How I Bought My First Duplex and Turned Rookie Mistakes Into Expert Strategy

Buying my first rental property was one of the most exhilarating—and terrifying—financial decisions I’ve ever made. I wasn’t a real…