Investing is a powerful tool for building wealth, but navigating the various strategies can be challenging. This guide will break down the concepts of passive and active investing, providing insights that will empower you to make informed decisions for your financial future.

What Is Active Investing

Active investing is a hands-on approach where investors directly control their investment decisions. This strategy is driven by the belief that financial markets are inefficient and can be exploited through practical research and analysis.

Active investors often use various techniques, such as market timing and stock picking, to outperform the market averages.

Typical Approaches and Strategies

1. Fundamental Analysis

Examining financial statements and other economic indicators.

2. Technical Analysis

Using historical price data and market trends to predict future movements.

3. Market Timing

Attempting to buy low and sell high based on market conditions.

Active Investment Opportunities

Active investing involves a hands-on approach, allowing investors to directly manage their assets and make strategic decisions to maximize returns.

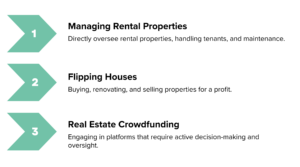

Examples of Active Investment Opportunities

Pros of Active Investing

Active investing is geared toward those who prefer direct control over their assets and are willing to dedicate time to managing their investments.

- Direct Control: Investors can influence outcomes by making informed decisions based on personal insights.

- Strategic Decision-Making: The ability to pivot strategies based on real-time market data can uncover potentially lucrative opportunities.

- Liquidity Timing: Investors can decide when to sell for maximum gains, optimizing their financial returns.

- Transparent and Lower Fees: In many cases, active investments may come with more transparent and potentially lower fees compared to passive strategies.

Understanding Passive Investing

Passive investing, on the other hand, adopts a more hands-off methodology, focusing on long-term growth without frequent trading or constant market monitoring.

Definition and Approach of Passive Investing

Passive investing aims for long-term growth by mirroring market performance through diversified portfolios, reducing the need for daily decision-making.

Overview of Common Passive Investment Strategies

- Index Fund Investing: Purchasing index funds that track the performance of specific market indices.

- REITs (Real Estate Investment Trusts): Investing in professionally managed portfolios of real estate assets.

Examples of Passive Investment Opportunities

- Real Estate Syndication: Investing in a real estate syndication where professional managers handle the properties.

- Pension Plans: Contributing to diversified pension plans without the necessity for hands-on management.

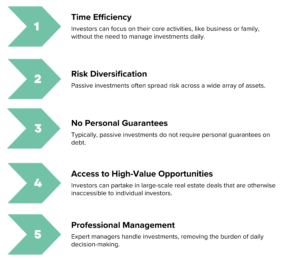

Pros of Passive Investing

Passive investing is suited for those who want to grow their wealth without dedicating significant time to their investments.

More On Active vs Passive Investing

How do passive real estate investments, such as REITs, compare to active property management in terms of long-term capital appreciation and cash flow generation?

Passive investments like REITs may offer more consistent dividend income, while active property management can lead to higher overall returns if managed well, though it might involve more risk and effort.

How can real estate investors effectively leverage tax incentives and depreciation differently in passive versus active real estate investments?

Active investors can take advantage of real estate professional status to maximize deductions, while passive investors may be limited to passive losses, though they can still benefit from depreciation and tax credits.

What are the advanced risk management strategies for balancing passive and active real estate investments in a diversified portfolio?

A balanced portfolio may involve allocating a set percentage to each strategy, regularly reviewing performance, and learning to hedge risks through diversification across asset types or geographical locations.

Conclusion

Determining whether Active vs Passive Investing works for you is not a one-size-fits-all decision. Each investment style offers distinct advantages and disadvantages, mainly dependent on personal goals and risk tolerance. Before diving into investing, consider what aligns best with your lifestyle and financial objectives.

How I Bought My First Duplex and Turned Rookie Mistakes Into Expert Strategy

Buying my first rental property was one of the most exhilarating—and terrifying—financial decisions I’ve ever made. I wasn’t a real…

Beyond the 4% Rule: Designing a Smarter FIRE Strategy with Real Assets

When people think about making money in real estate, they often think of one thing: appreciation. Buy low, sell high.…

From Layoff to Legacy: My Journey to Financial Independence Through Real Estate

In the spring of 2009, I drove to work in a BMW convertible, seat warmers on, thinking I had “made…

Introduction to Real Estate Syndication for Tech Professionals

As a tech professional looking to explore passive income opportunities in real estate, understanding real estate syndication is crucial. Real estate syndication…

Behind the Curtain: Our Journey to Finding the Best Opportunities For Investors

Many of our investors have been asking when our next investment opportunity will be available. While we don’t have anything…

102 Units Closed in Pullman, WA

We’re thrilled to announce the successful closing of a 102-unit multifamily acquisition—two 51-unit apartment properties located in Pullman, Washington. This…

Strategic Partnership: Creating Business Relationships That Count

Building strong networks is one of the most effective ways to accelerate business growth, opening doors to new opportunities and…

Value Add Investing – Supercharging Your Acquisition ROI

Value add investing has become a hot topic among real estate investors aiming to maximize their returns. This approach focuses…

Active vs Passive Investing: A Comprehensive Guide

Investing is a powerful tool for building wealth, but navigating the various strategies can be challenging. This guide will break…

How Understanding NOI Can Boost Your Investment Returns

Understanding NOI is essential for evaluating and driving real estate valuations effectively. This blog will walk you through the ins…