Many of our investors have been asking when our next investment opportunity will be available. While we don’t have anything ready to present right now, I wanted to pull back the curtain and share our meticulous process for finding and vetting deals.

The numbers might surprise you…

A Look Back at 2024: The Numbers Tell the Story

Let me break down our deal flow from 2024:

- High level review of over 200 potential deals

- Conducted deep-dive analysis on 30+ opportunities

- Submitted offers on 18 properties

- Went under contract on 9 deals

- Successfully closed on 3 apartment communities

But these numbers only tell part of the story. Let me walk you through what happens at each stage.

The Initial Review: Casting a Wide Net

In 2024, Max and I looked at close to 200 deals. This broad initial scan is crucial – we never want to miss a potential gem. At this stage, we’re doing our first-pass analysis: Does the property meet our basic criteria? Is it in our target market? Does the initial pricing make sense?

The Deep Dive: Where the Real Work Begins

From there, we identified 30+ deals that warranted a deeper look. This is where the real work begins. Each of these opportunities required several hours of intensive analysis:

- Running detailed financial models

- Stress-testing assumptions

- Analyzing market conditions

- Evaluating potential improvements

- Calculating probable returns

Making Moves: The Offer Stage

When a deal passes our initial scrutiny, we move quickly but carefully. We submitted 18 aggressive offers in 2024. Each offer is carefully structured to protect our investors while still being competitive in the market.

Under Contract: Where the Real Due Diligence Happens

Nine deals progressed to the contract stage. This is where we roll up our sleeves and verify every assumption:

- Conducting thorough property walks

- Securing insurance quotes

- Exploring debt financing options

- Verifying all financial assumptions

- Getting contractor bids for planned improvements

- Analyzing every aspect of the deal that could impact returns

The Final Filter: Only the Best Make It Through

Of those nine properties under contract, only three made it through our final filter to become actual investments. Why? Because we refuse to compromise on quality. Each deal that we present to our investors must:

- Meet our strict underwriting criteria

- Show strong potential for value add

- Demonstrate robust market fundamentals

- Offer compelling risk-adjusted returns

Why We’re So Selective

Some might look at these numbers – 200 deals reviewed to find 3 winners – and think we’re being too picky. We see it differently. Every deal we pass on is a potential problem we’ve helped our investors avoid. Our job isn’t to do as many deals as possible; it’s to find the right deals.

Looking Ahead to 2025

Currently, we’re in the winter months, and the market has its usual seasonal slowdown. But we’re actively sourcing new opportunities. Our target remains clear:

- Value-add opportunities in strong markets

- Properties with clear potential for improvement

- Deals that make sense in today’s lending environment

- Investments that meet our strict return criteria

We expect to have new opportunities to present by the end of Q1. Until then, we’ll keep analyzing, visiting properties, and doing the thorough work required to find deals that meet our standards.

The Bottom Line

We don’t rush deals just to have something to present. Our investors trust us with their capital, and we take that responsibility seriously. When we bring you a deal, you can be confident it’s been through a rigorous evaluation process and represents what we believe to be a truly compelling opportunity.

Stay tuned – we’ll keep you updated as soon as we find the right opportunity that meets our exacting standards.

Introduction to Real Estate Syndication for Tech Professionals

As a tech professional looking to explore passive income opportunities in real estate, understanding real estate syndication is crucial. Real estate syndication…

Behind the Curtain: Our Journey to Finding the Best Opportunities For Investors

Many of our investors have been asking when our next investment opportunity will be available. While we don’t have anything…

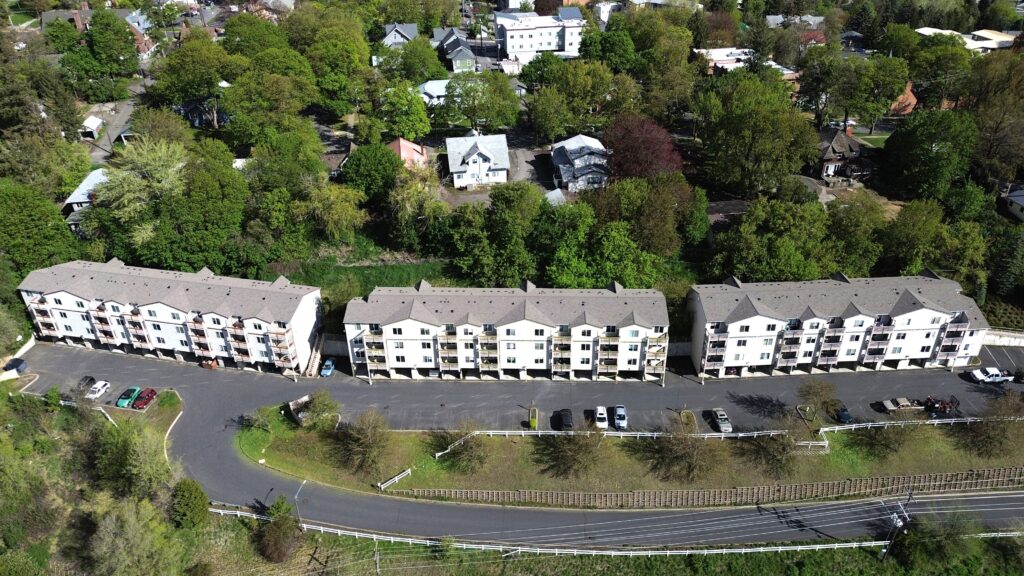

102 Units Closed in Pullman, WA

We’re thrilled to announce the successful closing of a 102-unit multifamily acquisition—two 51-unit apartment properties located in Pullman, Washington. This…

Strategic Partnership: Creating Business Relationships That Count

Building strong networks is one of the most effective ways to accelerate business growth, opening doors to new opportunities and…

Value Add Investing – Supercharging Your Acquisition ROI

Value add investing has become a hot topic among real estate investors aiming to maximize their returns. This approach focuses…

Active vs Passive Investing: A Comprehensive Guide

Investing is a powerful tool for building wealth, but navigating the various strategies can be challenging. This guide will break…

How Understanding NOI Can Boost Your Investment Returns

Understanding NOI is essential for evaluating and driving real estate valuations effectively. This blog will walk you through the ins…

What is Syndication?

In this blog, we will explore various dimensions of syndication, providing a clear understanding of its process, benefits, and legal…

Five Reasons Multifamily Will Outperform Other Assets Over the Next Five Years

When discussing with investors, I often express my optimism for the future of the multifamily market. Concerns about interest rates,…

Closed – Highland Apartments

Tamarack Capital has finalized the purchase of Highland Apartments, our new 30-unit apartment in Clarkston, WA! After three months of…